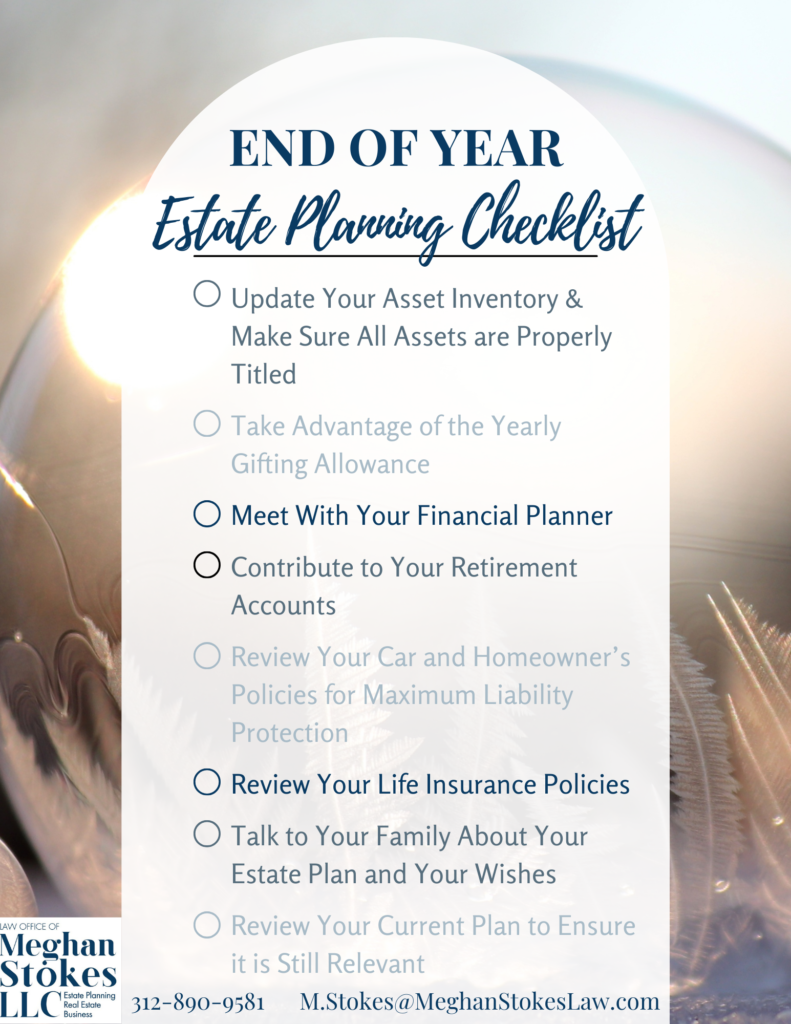

As we approach the end of the year, it’s not only the holiday season that demands our attention but also a critical time to ensure that your estate plan is in order. It is important to be proactive in securing your financial future and leaving a legacy that aligns with your wishes. Let’s dive into an end-of-year estate planning checklist that will help you navigate this crucial process.

1. Update Your Asset Inventory and Title

Start by taking stock of your assets. Ensure your asset inventory is up-to-date, including any recent acquisitions or changes in value. Equally important is confirming that all your assets are properly titled. If you have a trust, ensuring your assets are properly titled into the name of the trust ensures a seamless transition of your assets to your intended beneficiaries, minimizing complications during the administration process.

2. Leverage the Yearly Gifting Allowance

The annual gifting allowance is a powerful tool for estate planning. In 2023, you can gift up to $17,000 to a person without incurring gift taxes. Yes, this is per person! You could gift $17,000 to multiple people. If you are married, you and your spouse can each gift $17,000 to one person, giving them $34,000 total! Consider taking advantage of this allowance to reduce the size of your taxable estate. Gifting can also be a wonderful way to support loved ones during your lifetime and see how the financial assistance directly impacts their life.

3. Consult with Your Financial Planner

Schedule a meeting with your financial planner to review your current financial situation and align your goals with your estate plan. This collaboration ensures that your investments, savings, and other financial instruments are working cohesively to support your long-term objectives.

4. Contribute to Your Retirement Accounts

Maximizing contributions to your retirement accounts not only secures your financial future but can also offer tax benefits. Check your contributions for the year and make any necessary adjustments to ensure you’re making the most of available tax advantages.

5. Scrutinize Home and Auto Insurance Policies

Reviewing your car and homeowner’s insurance policies is crucial to guaranteeing maximum liability protection. Ensure that your coverage adequately safeguards your assets and accounts for any changes in your circumstances or property values. A lawsuit based on a slip and fall at your investment property or a car accident can quickly eat away at the money you want to leave your loved ones (or even live off of during retirement)!

6. Review Life Insurance Policies

Life insurance is a key component of many estate plans. Ensure that your policies align with your current needs, accounting for any changes in your family structure, financial situation, or overall goals. Confirm that beneficiaries are accurately listed and reflect your wishes. For instance, a married couple with young children may decide that they want their life insurance death benefit to be able to pay off the mortgage on their home, pay funeral and burial expenses, and leave enough money to fund their children’s college fund. Talk with your attorney about your chosen beneficiaries. There may be unintended consequences to listing specific people!

7. Communicate with Your Family

Talking about your estate plan with your family may not be the easiest conversation, but it is essential. Share your wishes, your reasoning behind those wishes, provide necessary information about your estate plan, and discuss any potential challenges your loved ones might face. Make sure they have a chance to ask questions (or even air grievances) in advance.

Open communication can prevent misunderstandings and help ensure a smooth transition when the time comes. If everyone is on the same page, conflict is less likely to occur once you are gone.

Also, make sure your loved ones know where to find your estate plan! The plan cannot be effective if no one can find it. Make sure to keep everything in one place to make it as easy as possible to make sure your wishes are carried out.

8. Ensure Relevance of Your Current Plan

Finally, review your existing estate plan to ensure it is still relevant. Life can change quickly, and circumstances change. What was right for your family last year, may not be the best option today. Births, deaths, marriages, divorces, and changes in financial status can all impact the effectiveness of your plan. Regular reviews and updates with your attorney are key to maintaining a comprehensive and effective estate strategy. Pro Tip: NEVER update your plan without speaking to your attorney first.

Taking the time to complete this end-of-year estate planning checklist can provide peace of mind and set the stage for a secure financial future. As we embark on the upcoming year, let’s ensure that our plans reflect our current circumstances and aspirations, paving the way for a legacy for our loved ones that resonates with our values and intentions.

Want help completing Your End of the Year Estate Planning Checklist? Email us at m.stokes@MeghanStokesLaw.com or give us a call at 312-890-9581.